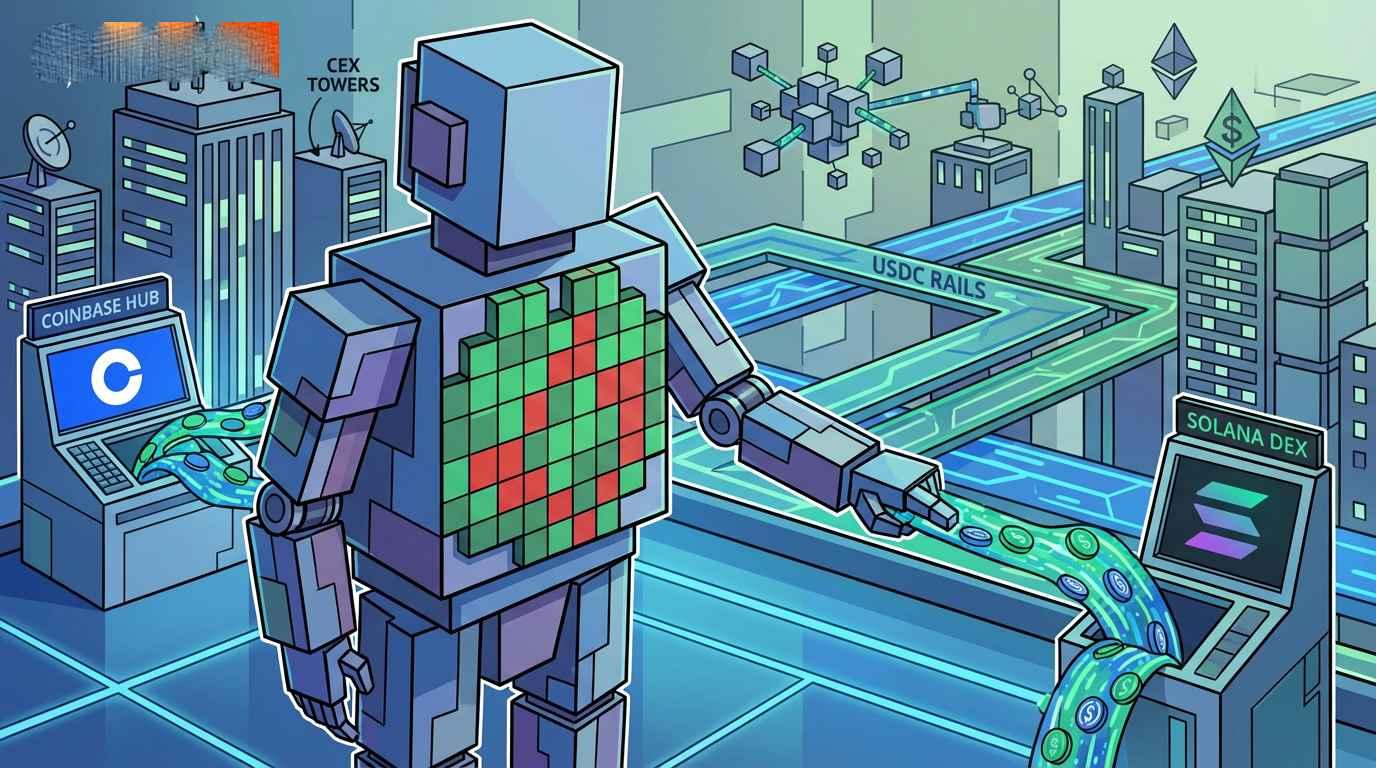

Coinbase Expands Solana Strategy With Direct On-Chain DEX Trading Inside Its App

A Broader Push Toward Hybrid On-Chain Infrastructure as Coinbase Integrates Solana DEX Liquidity

TL;DR

- Coinbase launched native Solana DEX trading inside its app, enabling direct on-chain swaps without listing individual Solana tokens.

- The rollout marks a strategic shift toward hybrid trading models as Coinbase faces thinning U.S. spot volumes and rising competition.

- The expansion deepens Coinbase’s ties to the Solana ecosystem, including its planned Vector.fun acquisition and institutional staking integrations.

We’ve just launched the all-new COIN360 Perp DEX, built for traders who move fast!

Trade 130+ assets with up to 100× leverage, enjoy instant order placement and low-slippage swaps, and earn USDC passive yield while climbing the leaderboard. Your trades deserve more than speed — they deserve mastery.

A major structural change quietly landed across Coinbase’s trading stack on December 11, 2025, as the exchange activated direct Solana DEX trading inside its app—allowing users to swap Solana-based tokens via on-chain liquidity rather than centralized order books. The move bypasses traditional token listings entirely, since execution routes through Solana’s decentralized exchanges, widening access to a broader set of assets while keeping the familiar Coinbase interface intact. The company framed the feature as part of its broader on-chain strategy, one that aims to thread the convenience of fiat on-ramps and card payments with the settlement transparency of decentralized execution. Users can fund swaps through USDC rails or conventional payment methods, tightening the link between mainstream financial flows and on-chain trading environments without requiring any specialist interaction with external wallets or DeFi interfaces.

A product shift of this magnitude arrives during a period of pressure on Coinbase’s centralized business, where weaker U.S. spot trading activity and a competitive surge from Robinhood, Kraken, and lower-fee venues have challenged growth. Executives have spent the past year expanding services that straddle both centralized onboarding and decentralized liquidity, applying this hybrid formula first on Base and now accelerating the same blueprint onto Solana. The approach aims to retain traders who increasingly expect self-custody pathways and trust-minimized execution while continuing to use regulated, consumer-grade platforms to move money into the market. These integrations also expand the landscape of assets surfaced through Coinbase’s interface, a meaningful shift for users tracking crypto price movements, monitoring the crypto price index, or evaluating shifts in coin market cap across newer Solana ecosystems.

A gradual rollout of supported Solana tokens mirrors the earlier Base deployment, reflecting Coinbase’s preference for staged additions rather than an all-at-once flood. Liquidity is sourced directly from Solana’s DEX pools, allowing users to control settlement flow without abandoning the platform’s guardrails, a balance that has become increasingly important as decentralized markets outpace centralized venues in asset diversity and speed. Social announcements tied to the launch emphasized that users can trade “all Solana tokens” via DEX routing, with no listing approvals required—a framing designed to highlight how decentralized integration frees Coinbase from traditional listing bottlenecks while preserving regulated front-end oversight.

A deeper alignment with the Solana stack is also taking shape behind the scenes. Coinbase continues moving forward with its planned acquisition of Vector.fun, a Solana-native memecoin and social-trading platform, reinforcing that the company sees long-term value in Solana’s user-driven culture and high-throughput design. Institutional clients using Coinbase Prime are also receiving expanded Solana-based tools, including staking options managed in partnership with Figment. These developments follow earlier expansions such as altcoin-indexed futures and governance-adjacent concepts for Base, though not every initiative has closed cleanly—discussions around acquiring BVNK were halted after due-diligence concerns.

A layered narrative emerges from this rollout: Coinbase is repositioning itself not as a pure centralized exchange but as a hybrid access point where regulated fiat rails meet permissionless liquidity. Direct Solana DEX trading represents the clearest expression of that shift to date, offering broader token access, more composability, and native on-chain execution while keeping the user journey anchored in a familiar interface. The push arrives at a moment when traders are increasingly gravitating toward ecosystems where execution speed and fee efficiency matter as much as brand trust, and where metrics such as crypto price, crypto price index trends, and coin market cap fluctuations are influenced by on-chain activity as much as centralized venues. Coinbase’s strategy suggests a recognition that the next phase of exchange competition will be shaped by who controls both the front door to fiat and the back end of decentralized liquidity—a contest now unfolding chain by chain, starting with Solana.

This article has been refined and enhanced by ChatGPT.