Crypto ETPs Shed $454 Million as Rate-Cut Expectations Cool and U.S. Investors Lead Withdrawals

Fed Policy Doubts Trigger Sharp Reversal in Crypto Investment Flows Despite Stable Industry AUM

TL;DR

- Crypto exchange-traded products recorded $454 million in weekly outflows as optimism around near-term Federal Reserve rate cuts faded.

- Bitcoin and Ether products drove the bulk of withdrawals, while select altcoins such as XRP and Solana still attracted inflows.

- U.S. investors accounted for the majority of outflows, even as total assets under management across crypto ETPs remained broadly stable.

We’ve launched the all-new COIN360 Perp DEX, built for traders who move fast!

Trade 130+ assets with up to 100× leverage, enjoy instant order placement and low-slippage swaps, and earn USDC passive yield while climbing the leaderboard. Your trades deserve more than speed — they deserve mastery.

Crypto investment products faced a decisive shift in sentiment last week as investors pulled $454 million from digital asset exchange-traded products, reversing early-year inflows and underscoring how tightly crypto price behavior remains linked to macroeconomic expectations.

Data compiled by CoinShares showed that the drawdown unfolded over four consecutive days, nearly erasing the roughly $1.5 billion in inflows recorded during the first two trading days of the year. Market participants pointed to growing skepticism over the likelihood of a near-term Federal Reserve interest rate cut, particularly after fresh macroeconomic data reduced confidence in a March easing cycle, prompting a rapid reassessment of risk exposure across crypto-linked instruments.

Bitcoin investment products absorbed the largest share of the selling pressure, with approximately $405 million exiting BTC-focused ETPs over the week. Ether products followed with $116 million in outflows, reinforcing a broader risk-off tone among the two largest digital assets by coin market cap.

Even short-Bitcoin products were not immune, posting about $9 million in outflows, a signal that investors were not aggressively positioning for further downside but were instead trimming exposure across the board. Multi-asset crypto products also saw $21 million in withdrawals, reflecting weakness beyond single-asset strategies as uncertainty rippled through the crypto price index and related benchmarks.

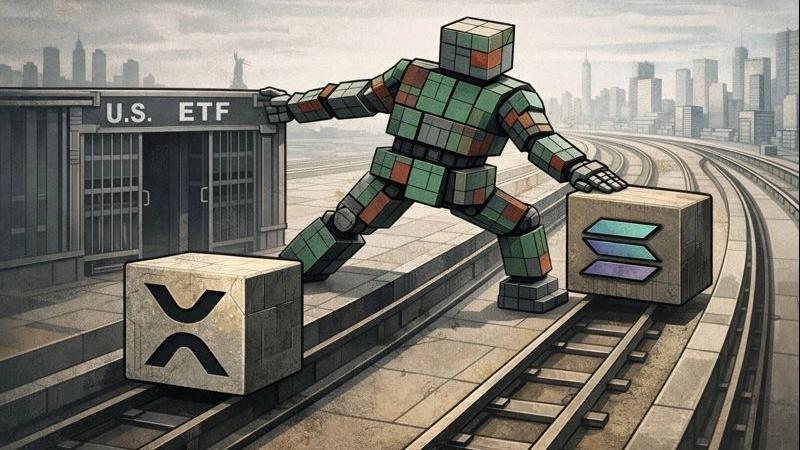

Despite the broad pullback, flow data revealed notable pockets of resilience. XRP-linked products recorded around $46 million in inflows, while Solana attracted roughly $33 million and Sui about $8 million, suggesting selective rotation rather than a uniform retreat from digital assets.

These inflows indicated that some investors continued to favor specific narratives and ecosystems even as headline crypto price moves softened. Geographically, the divergence was stark. U.S.-listed products accounted for roughly $569 million in net outflows, making the United States the clear epicenter of the sell-off. Germany, Canada, and Switzerland moved in the opposite direction, collectively posting tens of millions of dollars in net inflows, highlighting regional differences in risk appetite and macro interpretation.

Issuer-level data added further nuance to the picture. BlackRock’s iShares crypto products and Profunds Group were among the few to register net inflows, each drawing in roughly $180 million, while Fidelity Investments and Grayscale Investments experienced significant redemptions of about $454 million and $360 million, respectively.

Even with the heavy outflows, total assets under management across crypto ETPs edged higher week over week to $181.9 billion from $181.3 billion, suggesting that longer-term holdings and underlying crypto price stability helped cushion the impact. CoinShares research head James Butterfill summarized the mood succinctly, noting that the turnaround in sentiment appeared largely driven by investor concerns over diminishing prospects for a Federal Reserve rate cut following recent economic data, a reminder that macro expectations continue to shape crypto price dynamics as much as on-chain developments.

This article has been refined and enhanced by ChatGPT.