This Week’s Legal Shockwaves: Kidnapping, Sanctions, and SEC’s Binance Exit

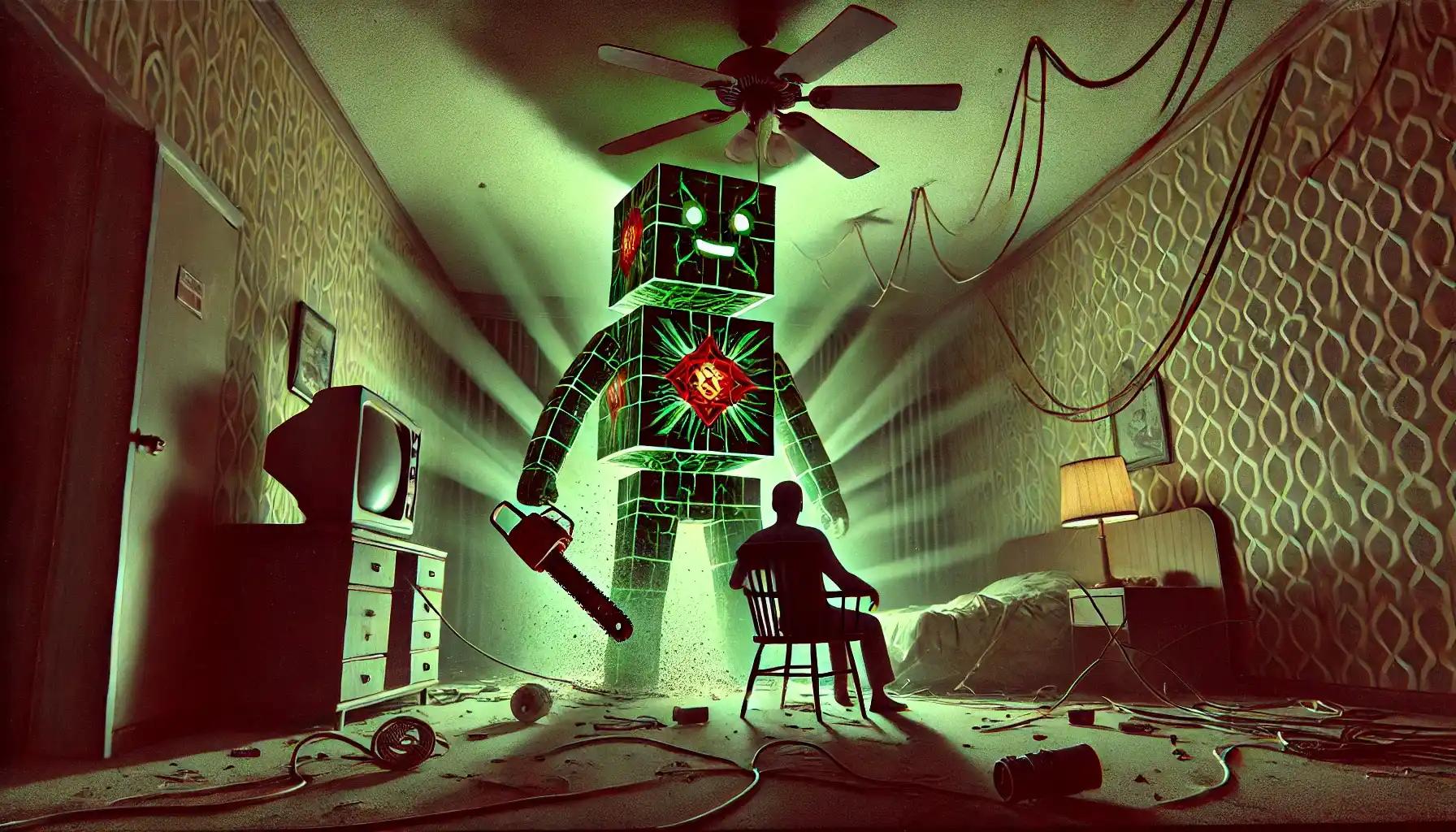

"Crypto King of Kentucky" Arrested for Kidnapping and Torturing Bitcoin Investor

John Woeltz, known as the 'Crypto King of Kentucky,' has been arrested for kidnapping and torturing a Bitcoin investor in New York. Woeltz allegedly held the Italian man captive for over two weeks, attempting to extract his Bitcoin password through extensive physical abuse, including threats of violence and the use of a chainsaw. The victim escaped by feigning willingness to provide the password. Woeltz faces serious charges, including two counts of second-degree assault and first-degree kidnapping, with potential prison sentences ranging from 15 to 25 years. Bail has been denied due to concerns about him being a flight risk.

SEC Drops Lawsuit Against Binance, Marking Shift in Crypto Regulation Strategy

The SEC has dropped its lawsuit against Binance, resolving a nearly two-year legal battle. A joint motion filed on May 29, 2025, seeks to dismiss the complaint from June 2023 with prejudice, preventing re-filing. The SEC's Crypto Task Force may influence this decision, suggesting a shift in enforcement strategy. Earlier, Binance faced a $4.3 billion fine and sanctions violations, leading to CEO Changpeng Zhao's resignation and a prison sentence. This dismissal reflects a broader retreat from aggressive crypto regulation under the Biden administration, following similar actions against firms like Coinbase and Kraken as the SEC seeks to establish clearer policies.

Sam Bankman-Fried to Be Released from Prison on December 14, 2044, After Serving Less Than 21 Years

Sam Bankman-Fried, the former FTX CEO, is set to be released from prison on December 14, 2044, serving less than 21 years of his 25-year sentence. He was found guilty in November 2023 of orchestrating a $8 billion fraud scheme. After spending nearly two years in a New York federal prison, he was transferred to Oklahoma following a solitary confinement incident. Meanwhile, his associates, Caroline Ellison, Gary Wang, and Nishad Singh, received varying sentences, with Ellison getting two years and the others avoiding jail time. FTX plans to distribute up to 120% to creditors starting May 30, 2025.

Judge Vacates Fraud Convictions of Mango Markets Thief; Eisenberg Remains in Jail for Unrelated Charges

A U.S. federal judge, Arun Subramanian, has overturned three criminal convictions of Avraham Eisenberg, accused of stealing $110 million from the decentralized exchange Mango Markets. The judge found insufficient evidence that Eisenberg made false representations, stating that the market was "permissionless and automatic." Furthermore, the court determined that New York was an improper venue for the case because Eisenberg executed trades from Puerto Rico. Despite the vacated convictions, Eisenberg remains incarcerated, serving a four-year sentence for unrelated charges involving child sexual abuse material. This ruling leaves significant implications for jurisdiction in crypto-related fraud cases.

U.S. Treasury Sanctions Funnull Technology for Enabling $200 Million "Pig Butchering" Scams

The U.S. Treasury sanctioned Funnull Technology Inc. and its administrator, Liu Lizhi, for enabling "pig butchering" scams that defrauded Americans of over $200 million, with average losses of $150,000 per victim. Funnull reportedly sold IP addresses to criminals for scam platforms and is linked to the most crypto investment scams reported to the FBI. The Treasury emphasized its commitment to disrupting such cyber scams, which have seen a nearly 40% increase in illicit revenue year-over-year in 2024. Funnull used algorithms to generate unique domain names, aiding cybercriminals in creating and shifting fraudulent websites.

This article has been refined and enhanced by ChatGPT.