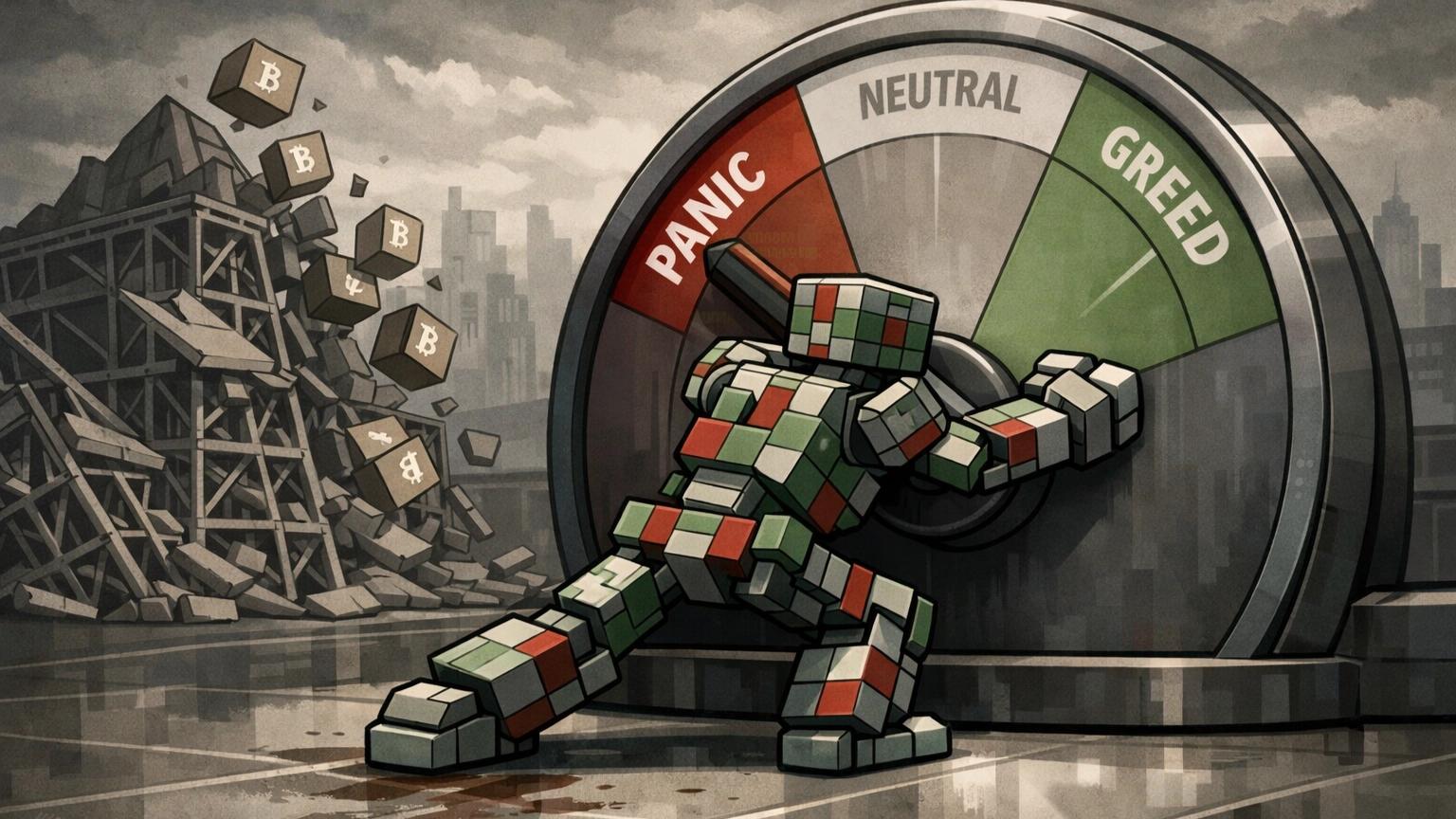

Weekly Crypto Sentiment: Earnings Misses and Bankruptcies Trigger Market Unwind as Fear & Greed Index Hits Record Low

The Crypto Fear and Greed Index recently hit an all-time low of 5 on February 6, 2026, indicating severe market panic, driven by macroeconomic pressures and over $2.5 billion in leveraged liquidations. Bitcoin mirrored this sentiment, plummeting 52% from its October 2025 high of $126,000 to $60,062.

The sell-off unfolded alongside a wave of disappointing earnings reports from major crypto-linked firms, coupled with mounting headlines around operational shutdowns, bankruptcy filings, and focus shifts that amplified concerns this week.

We’ve launched the all-new COIN360 Perp DEX, built for traders who move fast!

Trade 130+ assets with up to 100× leverage, enjoy instant order placement and low-slippage swaps, and earn USDC passive yield while climbing the leaderboard. Your trades deserve more than speed — they deserve mastery.

Coinbase Q4 2025: $667M Loss, Revenue Miss & CEO Sells $550M Stock Amid Market Slump

Coinbase reported a $667 million net loss in Q4 2025, snapping an eight-quarter profitability streak with ~20–22% year-over-year revenue decline to ~$1.78 billion and transaction fees down sharply as crypto trading activity slumped amid broader market weakness and BTC/ETH price drops, according to earnings released February 12, 2026. CEO Brian Armstrong sold about $550 million in COIN stock under an existing Rule 10b5-1 plan over 2025–2026, drawing investor sentiment scrutiny despite pre-planned disclosures. Coinbase’s stock weakened on the earnings miss and insider selling narrative.

Robinhood Q4 Crypto Revenue Collapses 38%, Shares Slide as Layer-2 Launch and ARK Accumulation Signal Strategic Pivot

Robinhood reported Q4 2025 results with total revenue of $1.28 billion, missing Wall Street targets, as crypto transaction revenue plunged ~38% YoY to ~$221 million, driving shares down ~11.5% amid reduced retail trading and softer engagement (monthly users ~13M). Amid the slump, analysts trimmed price targets but held long-term views. ARK Invest aggressively added Robinhood stock (~$50M), making it a top portfolio holding despite weak sentiment. Management emphasizes diversification, prediction markets growth, and blockchain initiatives to offset crypto volatility and reshape growth. Robinhood launched its Layer-2 blockchain to support tokenized assets and infrastructure expansion.

Crypto VCs Shift Focus to AI and Cash Flow Amid Market Doubts, Warns Moonrock's Simon Dedic

Simon Dedic, Founder of Moonrock Capital, warns of a notable shift in sentiment among crypto VCs, with many doubting a full market recovery. In recent discussions, at least five major VCs expressed their concerns or have exited to focus on AI and Web2 equities. Similarly, Arthur Cheong of DeFiance Capital believes the traditional crypto venture model is broken, advocating a pivot to cash flow generation. Cheong's "Liquid Venture Fund" will target projects with proven revenue models, particularly in Decentralized Finance (DeFi) and Real-World Asset (RWA) tokenization, citing successful platforms like Hyperliquid as examples.

Archblock LLC Files for Chapter 11 Bankruptcy Amid $100M Liabilities and Legal Challenges

Archblock LLC, formerly known as TrustToken, has filed for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the District of Delaware, reporting over $100 million in liabilities against just $10 million in assets. The company, founded in 2017 and known for the TrueUSD stablecoin and TrueFi uncollateralized lending protocol, has struggled amid a harsh crypto market. The bankruptcy filing identifies six debtor entities and lists Alameda Research as a potential creditor with an $8.5 million unsecured claim. Archblock faces legal challenges from Celsius Network, which claims it was misled about TrueCurrency token collateralization.

Bitcoin Miner NFN8 Files for Chapter 11 Bankruptcy, Secures $2.75M Financing to Maintain Operations

NFN8, a Bitcoin mining firm, has filed for Chapter 11 bankruptcy in Texas, seeking to liquidate assets while maintaining some operational continuity. The company secured $2.75 million in debtor in possession financing to sustain operations during the bankruptcy process. This filing reflects the volatile conditions of the Bitcoin mining sector, which faces challenges such as fluctuating BTC prices, high capital expenditures, and increasing competition. The outcome of NFN8’s restructuring will depend on market conditions and creditor negotiations, impacting investor sentiment and the broader mining community's financial health. The situation emphasizes the risks involved in Bitcoin mining investments.

This article has been refined and enhanced by ChatGPT.