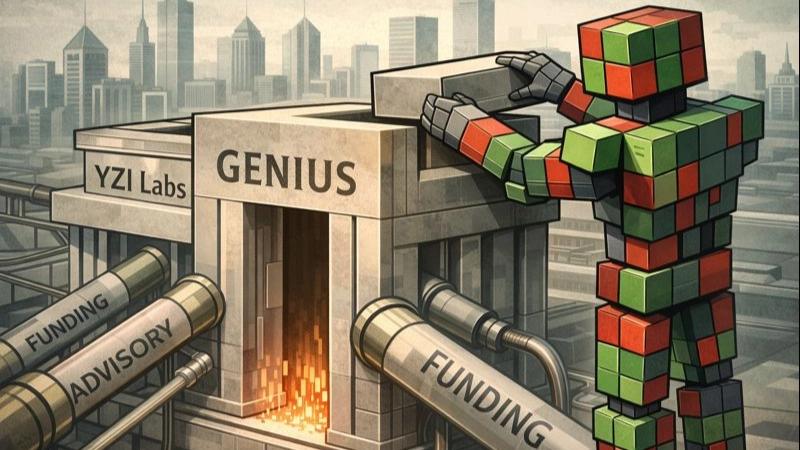

YZI Labs Backs Genius Trading With Multi-Eight-Figure Investment as CZ Joins as Advisor

Cross-Chain Trading Infrastructure Draws Strategic Capital Amid DeFi Execution Shift

TL;DR

- YZI Labs made a multi-eight-figure investment in Genius Trading, confirming CZ as an advisor.

- Genius reported over $160 million in trading volume across 10 blockchains before its public debut.

- The deal reflects rising demand for cross-chain execution tools as on-chain trading volumes expand.

We’ve launched the all-new COIN360 Perp DEX, built for traders who move fast!

Trade 130+ assets with up to 100× leverage, enjoy instant order placement and low-slippage swaps, and earn USDC passive yield while climbing the leaderboard. Your trades deserve more than speed — they deserve mastery.

YZI Labs disclosed a multi-eight-figure strategic investment in Genius Trading on January 13, 2026, marking one of its most visible bets on decentralized trading infrastructure. The funding places Genius among a growing group of execution-focused platforms attracting capital as on-chain activity increasingly rivals centralized venues.

Genius Trading entered the spotlight with claims of more than $160 million in cumulative trading volume processed before its public debut. The platform supports spot trading, perpetual futures, and copy trading across at least 10 blockchains, positioning itself as a unified terminal rather than a single-chain DEX or liquidity pool.

Changpeng “CZ” Zhao, founder of Binance and head of YZI Labs, joined Genius as an advisor as part of the deal. The advisory role signals deeper strategic involvement, not just financial backing, at a time when experienced exchange operators are increasingly influencing DeFi tooling design.

YZI Labs framed the investment around structural changes in how traders execute large orders on public blockchains. Transparent ledgers, while foundational to DeFi, expose trade intent and can weaken execution quality, especially during volatile crypto price swings reflected across the crypto price index and broader coin market cap movements.

Genius has addressed this challenge through features such as its “Ghost Order” system, which splits and routes trades across multiple wallets to reduce visibility while remaining non-custodial. The company positions this approach as an attempt to replicate centralized exchange execution standards without sacrificing on-chain settlement.

Leadership at Genius described the partnership as alignment beyond capital, emphasizing development support and operational insight. The company plans to accelerate privacy and routing features, with a broader access rollout targeted for late 2026, according to statements accompanying the announcement.

Market data cited by YZI Labs highlights why execution infrastructure has become a focus. Decentralized exchanges expanded their share of spot trading volume from 6% in early 2021 to over 21% by November 2025, peaking near 37% during mid-2025 market surges tied to crypto price volatility.

YZI Labs manages roughly $10 billion as a family office and has backed more than 300 companies across Web3 and emerging technologies. The Genius investment fits within its broader strategy, including a $1 billion fund dedicated to builders, as trading activity increasingly migrates on-chain alongside shifts in the global coin market cap.

This article has been refined and enhanced by ChatGPT.