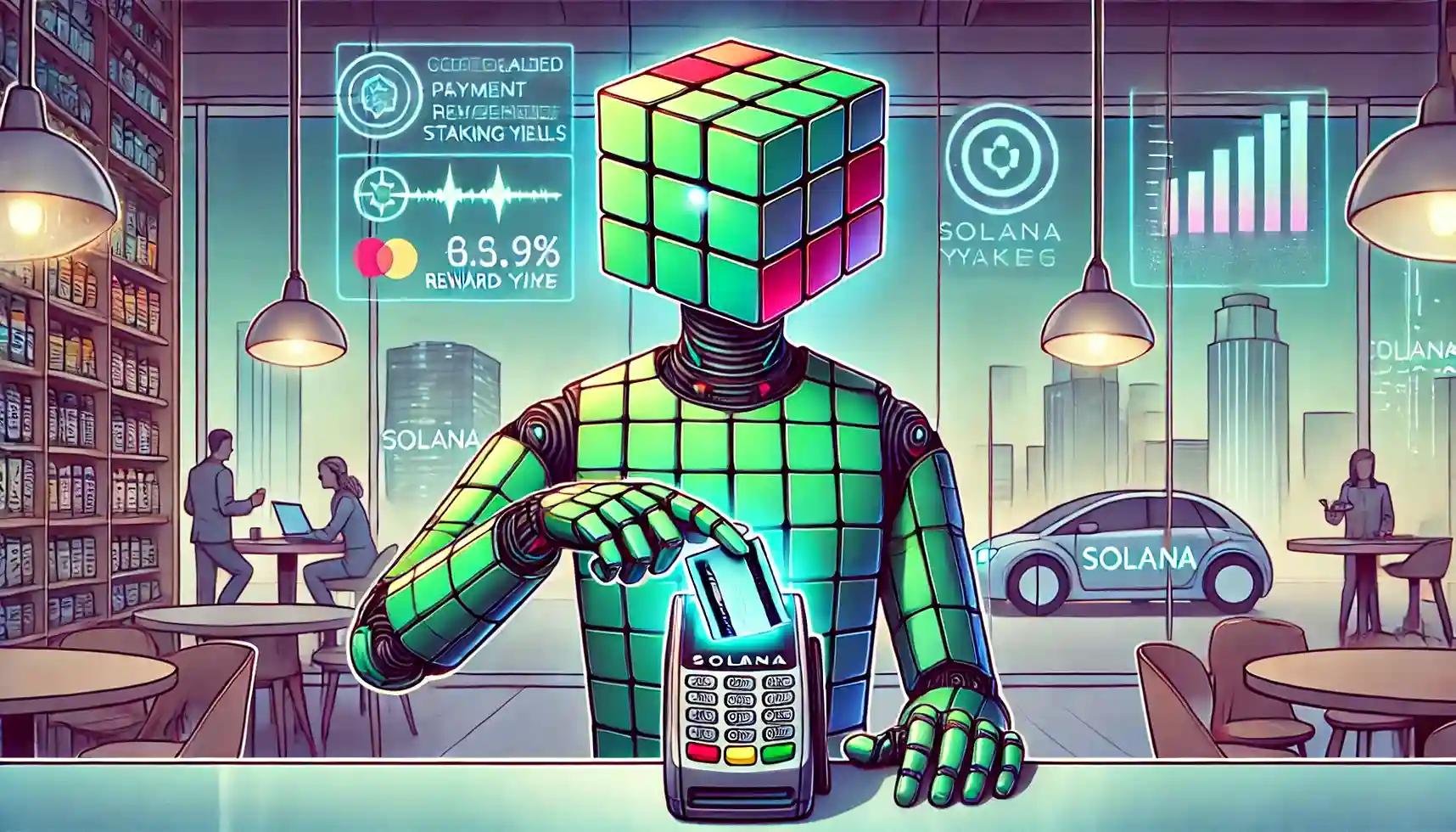

Gemini Unveils Solana Credit Card With 4% Crypto Rewards and 6.77% Staking Yield Integration

New Solana-branded credit card offers up to 10% crypto rewards and direct staking

TL;DR

- Gemini launched a Solana-themed credit card offering up to 4% in SOL rewards and up to 6.77% staking yield

- Auto-staking is available immediately, with flexible unstaking and no annual or foreign transaction fees

- Cardholders who held SOL rewards historically saw up to 299.1% return, per Gemini’s own data

Gemini has launched a new version of its crypto credit card, this time fully themed around the Solana blockchain, allowing users to earn rewards in SOL and have them automatically staked for yield. Announced on October 20, 2025, the Solana Edition Gemini Credit Card offers crypto-native incentives on everyday purchases, including up to 4% in Solana for fuel, EV charging, and rideshare expenses, 3% on dining, 2% on groceries, and 1% across all other categories. Certain merchant partnerships provide up to 10% back, making it one of the most aggressive crypto reward structures currently on the market based on the current crypto price index.

One of the standout features is the integrated auto-staking of SOL rewards, which allows cardholders to passively participate in securing the Solana network and earn up to 6.77% annual yield, according to Gemini’s listed APR. While users can choose to unstake anytime, the exchange notes that funds may take from several hours to multiple days to be fully available after unstaking, depending on network conditions. The staking component is designed to simplify user interaction with DeFi protocols by automating a typically complex process and tying it directly to retail spending behavior. Gemini’s offering reinforces an emerging trend in payments where credit cards not only accumulate crypto but also compound it.

The Solana Edition card is issued via WebBank and runs on the Mastercard World Elite network. There are no annual fees or foreign transaction costs. Although SOL is the featured token, users can still rotate their crypto rewards between over 50 supported cryptocurrencies on the Gemini platform, including bitcoin and ether. The card includes a custom Solana-branded design, aiming to connect more deeply with one of the fastest-growing developer ecosystems in the space. Gemini stated its selection of Solana for the card was based on the network’s “momentum” and the strength of its active community, signaling confidence in the blockchain’s long-term utility and alignment with consumer-facing financial products.

Performance data released by Gemini further illustrates the earning potential of the card. Internal metrics cited by the company on July 27, 2025, showed that customers who chose SOL as their reward currency and held onto it between October 2021 and October 2024 saw an estimated return of 299.1% by October 2025. This figure underscores both the volatile upside of crypto price movements and the potential compounding benefits of holding blockchain-native assets. Still, Gemini clarified that past returns do not guarantee future performance and that staking rewards are not fixed, varying with network dynamics and validator participation.

The launch arrives as the crypto credit card sector becomes increasingly competitive, with products attempting to blend conventional consumer incentives with decentralized finance mechanisms. Gemini’s focus on staking yields and token-centric branding reflects a maturing space where the coin market cap is no longer just about trading, but about practical usage, loyalty mechanics, and integrated yield. By connecting a traditional payment tool with onchain staking infrastructure, Gemini aims to redefine how users engage with the crypto price index — not just by watching it, but by earning directly from it.

This article has been refined and enhanced by ChatGPT.