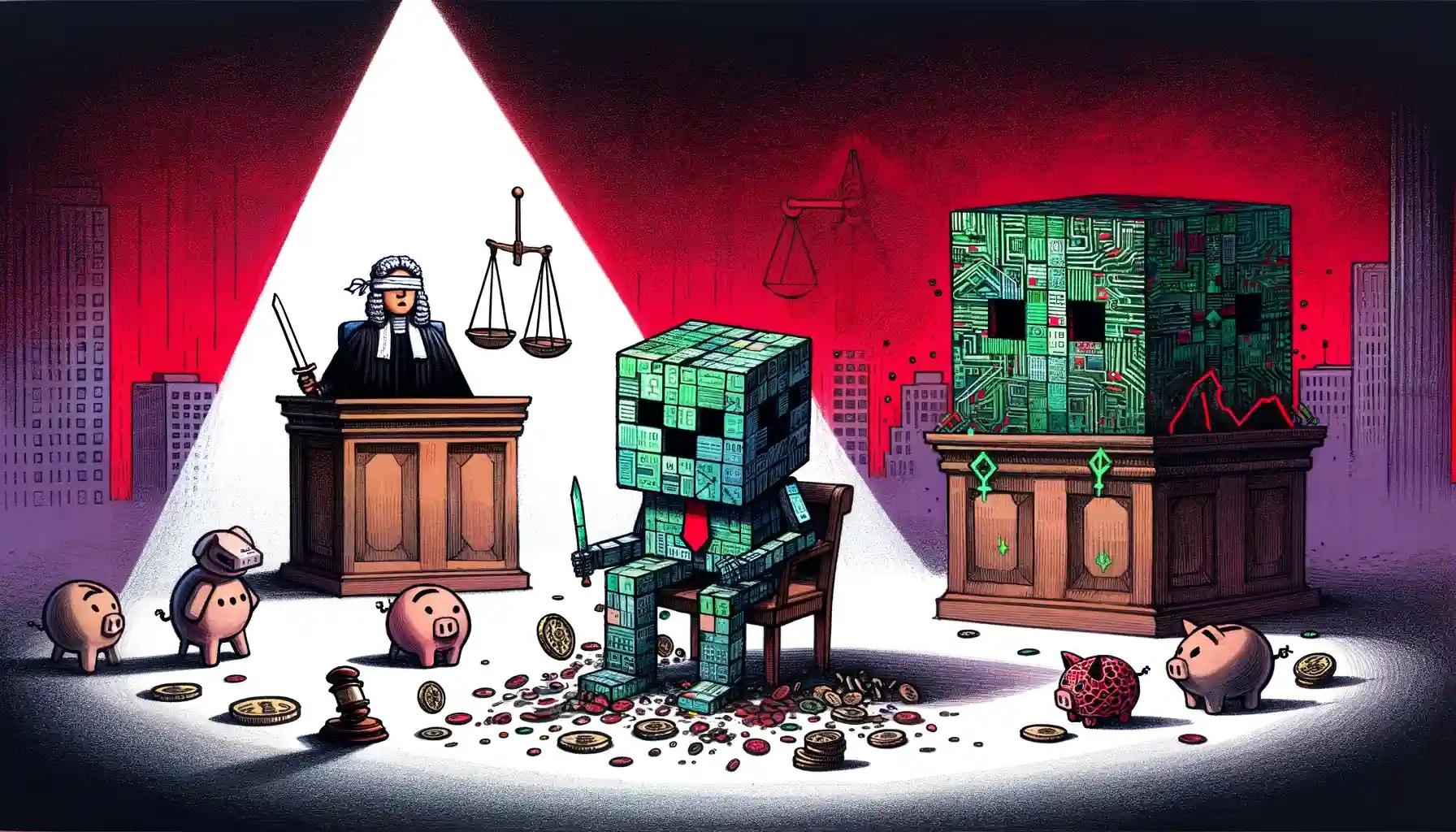

Do Kwon and Terraform Labs Settle with SEC Amidst Broader Legal Turmoil

Kwon, Terraform Labs Settle SEC Charges Over LUNA, TerraUSD Fraud

Terraform Labs, headed by Do Kwon, is known for creating the LUNA cryptocurrency and TerraUSD (UST) stablecoin. Their collapse in May 2022 triggered a $40 billion market downturn, ushering in the "crypto winter."

Recently, Reuters reported a tentative settlement between Terraform Labs and the U.S. Securities and Exchange Commission (SEC) regarding fraud charges. This development follows the April 2024 guilty verdict by a New York jury, which found Kwon and Terraform Labs guilty of defrauding investors by misrepresenting TerraUSD's stability.

The settlement agreement, disclosed on a recent date, stipulates that court filings are due by June 12, 2024. This agreement is expected to outline financial penalties for Kwon and Terraform Labs and could impact Kwon’s future roles in the financial sector. Following the news, LUNA’s price surged by as much as 20%.

Do Kwon’s legal troubles are far from over. The U.S. Department of Justice has charged him with criminal fraud related to the collapse of Terraform Labs, while South Korea accuses him of fraud, bribery, manipulating transaction volumes, and violating capital market laws.

Both countries are seeking his extradition following his arrest in Montenegro for using a false passport in December 2023. Kwon served a four-month sentence in Montenegro and remains there pending extradition decisions.

After the news, Luna Foundation Guard (LFG) transferred 1.974 million AVAX ($71.2 million) and 39.499k BNB ($23.5 million) to an unknown address. This triggered a bearish trend in AVAX and BNB prices, with AVAX trading at $36.13 and BNB at $593.14. BNB's market cap is $87.5 billion, and despite a price dip, a 6% increase in trading volume suggests rising demand.

Conclusion

The specific terms of the settlement will be detailed in the upcoming court filings. The outcome of Kwon’s extradition and further legal proceedings in both the U.S. and South Korea remains uncertain. The broader implications for the cryptocurrency market and future regulatory measures will be closely watched.

FAQs

What is the recent development regarding Do Kwon and Terraform Labs?

A tentative settlement has been reached with the U.S. Securities and Exchange Commission (SEC) regarding fraud charges. Court filings detailing financial penalties are due by June 12, 2024.

What are the other legal troubles faced by Do Kwon?

Do Kwon faces criminal fraud charges from the U.S. Department of Justice and accusations of fraud, bribery, and market manipulation from South Korea. Both countries are seeking his extradition following his arrest in Montenegro.

What are the implications of this settlement?

This settlement could set a precedent for handling similar cases in the cryptocurrency industry. The positive reaction of LUNA's price suggests investor optimism about resolving these legal challenges. However, the broader implications for the cryptocurrency market and future regulations remain uncertain.

This article has been refined and enhanced by ChatGPT.